Equity Bank Uganda a subsidiary of Equity Group Holdings Limited from Kenya is in hot soup after withdrawing a customer's deposits without her permission.

Edith Nakacwa, a 24-year-old student and business woman was the victim of this latest swipe from the Kenyan owned bank.

Edith found out almost all her total deposit (money) with the bank was missing on the day she wanted to make payment for a laptop she was planning to buy.

This was on April 23rd of this year from an Equi Duuka agent who told her that she only had about 59,000 Ugandan shillings in the bank account she thought had 21.9 million balance.

What did Edith Nakacwa do after this shock

Definitely, she could not purchase her laptop as earlier planned but now wrote to Equity Bank that very day to notify them of loss of money without her knowledge from her savings account.

She personally delivered the letter to Equity Bank, Church House where Mr Denis Obua, Head of security confirmed that her case was one of fraud after critical analysis of the abnormal transactions from her bank statement.

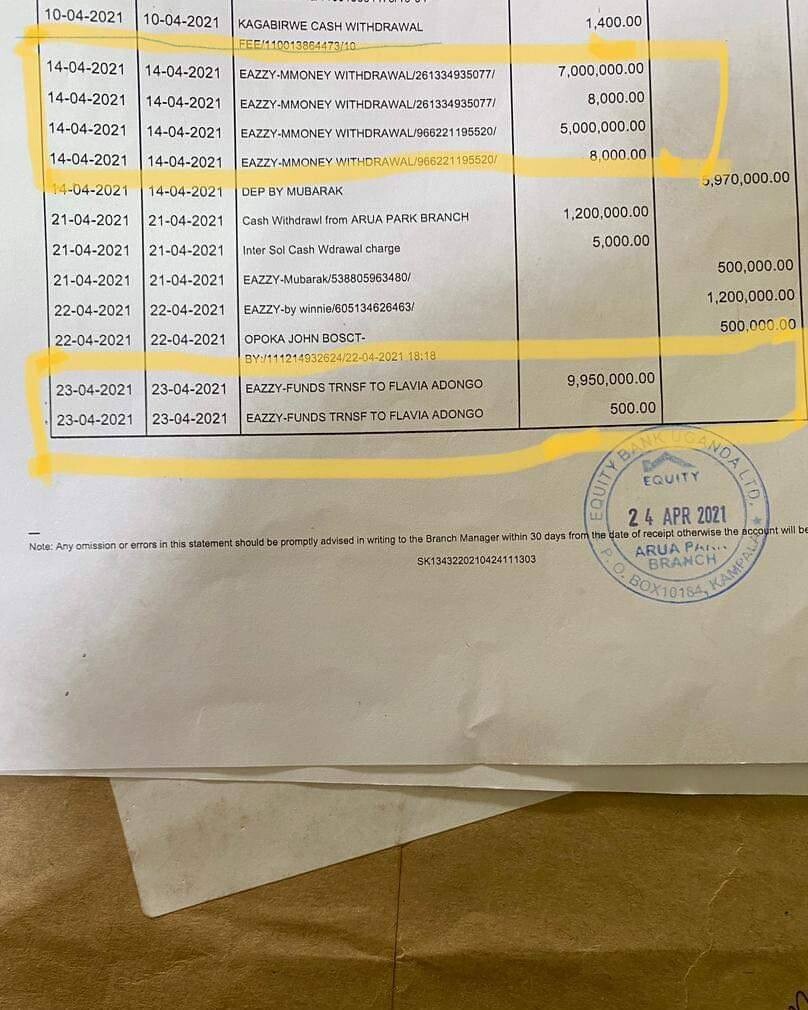

The bank statement also showed that all the money was transferred to fraudsters using the Eazzy funds app, a mobile application Equity Bank developed to make bank transactions easier.

Edith was told that 9 million which was part of the 21.9 million lost was sent to a one Flavia Odongo, someone she denied knowledge of. She said she has never met nor does she know anyone called Flavia Odongo.

The rest of the money was transferred to other phone numbers and this was 5 million and 7 million on different days which left her bank account dry like Sahara Desert with only 59,100 shillings.

So what happened with the refund

Since the head of security at Equity Bank Church House, Mr Obua had confirmed the case as fraud, one would expect the bank to immediately refund the money but little did Edith know that she was in for a ride.

Obua had promised to refund Edith on that very Monday she reported but later told her that the refund requires approval from the board of directors who were to hold a meeting on Wednesday and assured her, he would call soon to update her.

After that meeting, Obua never got back to her and Edith being frustrated, she posted a series of tweets while tagging the bank and this landed her into trouble when she appeared in Obua's office the following Monday.

Edith Nakacwa gets in trouble because of twitter

Obua scolded her for tweeting which embarrassed the bank and assured her of how her money is very little and can be refunded in the blink of an eye since Equity Bank is a very big institution.

It's from here that he angrily stated that twitter should "refund her money" !

He further went on and assured her of how she has no chance of defeating the bank even in court incase she tried to settle the matter legally.

After these harsh words, Edith ran straight to her lawyers and started a legal case by writing a letter to the Bank of Uganda about the matter.

Ms Charity Mugumya, director for communications in Bank of Uganda then reached out to Equity Bank ordering an independent inquiry into the matter.

The bank in panic immediately started working on Edith's case and refunded her money in full last week after a small delay from the second Corona lockdown.

However, the central bank (Bank of Uganda) noted that they only came in because Equity which is supposed to solve the problem had refused to do so.